Homeowners Insurance in and around Farmville

Protect what's important from catastrophe.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Virginia

- Farmville

- Prince Edward County

- Cumberland County

- Charlotte County

- Appomattox County

- Buckingham County

- Amelia

- Rice

- Dillwyn

- Prospect

- Moseley

- Pamplin

Insure Your Home With State Farm's Homeowners Insurance

Everyone knows having fantastic home insurance is essential in case of a tornado, fire or ice storm. But homeowners insurance is about more than covering natural disaster damage. An additional feature of home insurance is that it also covers you in certain legal cases. If someone slips in your home, you could be required to pay for physical therapy or their lost wages. With adequate home coverage, these costs may be covered.

Protect what's important from catastrophe.

The key to great homeowners insurance.

Protect Your Home With Insurance From State Farm

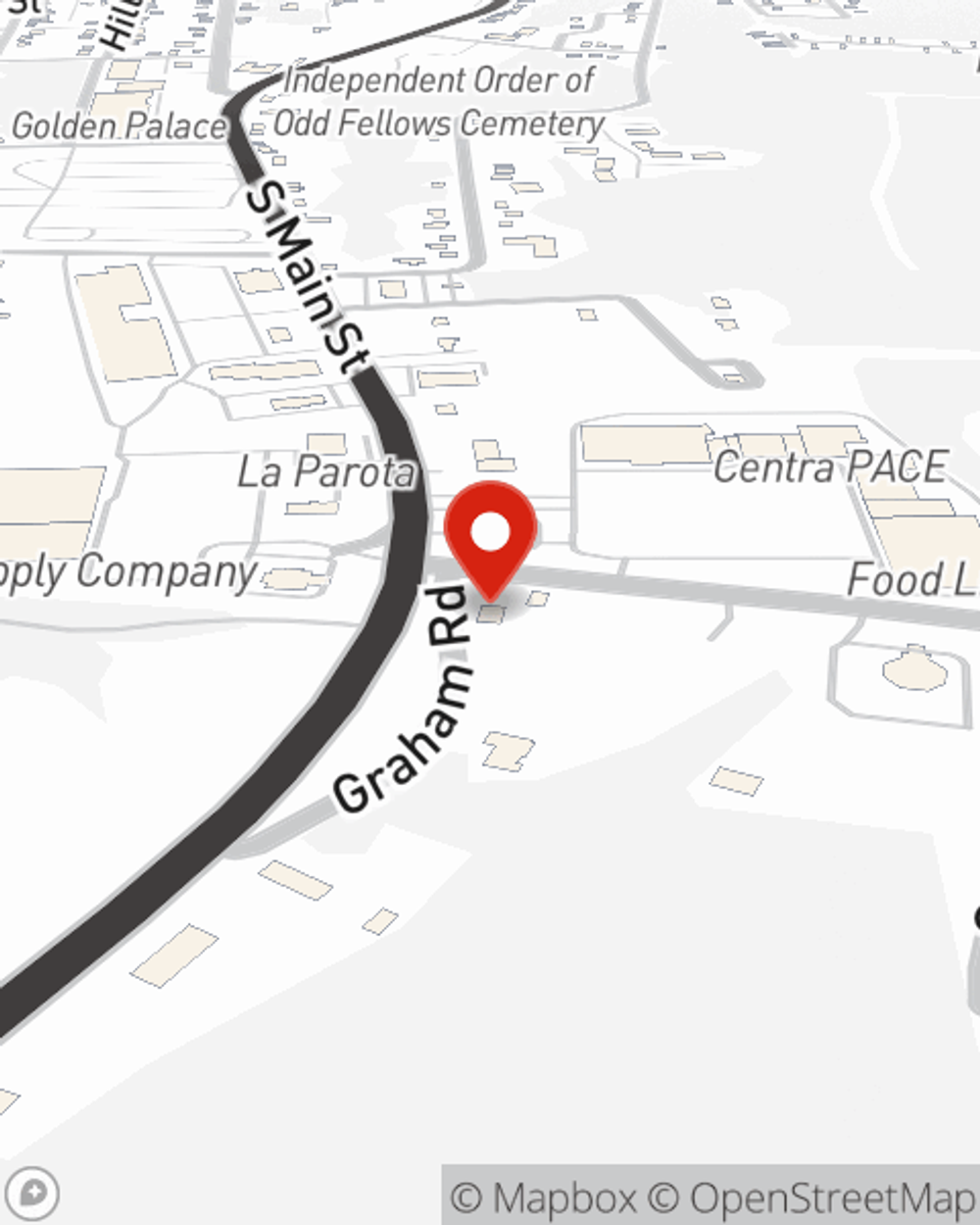

That’s why your friends and neighbors in Farmville turn to State Farm Agent Edgar Jones. Edgar Jones can explain your liabilities and help you find a policy that fits your needs.

There's nothing better than a clean house and coverage with State Farm that is value-driven and dependable. Make sure your valuables are covered by contacting Edgar Jones today!

Have More Questions About Homeowners Insurance?

Call Edgar at (434) 392-4357 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How a storm shelter or safe room can help protect against severe weather

How a storm shelter or safe room can help protect against severe weather

Constructing a storm shelter or safe room space within your home can help protect you from natural disasters and weather emergencies.

The pros and cons of paying off a mortgage early

The pros and cons of paying off a mortgage early

If you have extra funds, you may think about paying off a mortgage early. But review some key questions before you make that payment.

Edgar Jones

State Farm® Insurance AgentSimple Insights®

How a storm shelter or safe room can help protect against severe weather

How a storm shelter or safe room can help protect against severe weather

Constructing a storm shelter or safe room space within your home can help protect you from natural disasters and weather emergencies.

The pros and cons of paying off a mortgage early

The pros and cons of paying off a mortgage early

If you have extra funds, you may think about paying off a mortgage early. But review some key questions before you make that payment.